Investors nowadays prefer to incorporate a small percentage of physical gold or other precious metals, more specifically silver, platinum, and palladium, as part of their investment portfolio.

Many do so as part of a retirement strategy holding the metals in a self-directed IRA, a somewhat complicated ordeal. It is so because it involves IRS regulations, a specialized custodial service, storage in an approved depository, and on.

In order to simplify the process to a degree, more people are seeking the services of knowledgeable, well-qualified, client-oriented gold IRA firms like SD Bullion. Check a review for this award-winning company at https://www.bondsonline.com/SD-bullion-review/.

These sorts of customer-centric gold IRA firms have experts specializing in the intricacies that comprise the government rules for self-directed accounts holding precious metals.

There are resources to assist with setting up and facilitating the precious metal purchase. The company aims to provide adequate guidance to ensure compliance and preserve and encourage continued wealth accumulation.

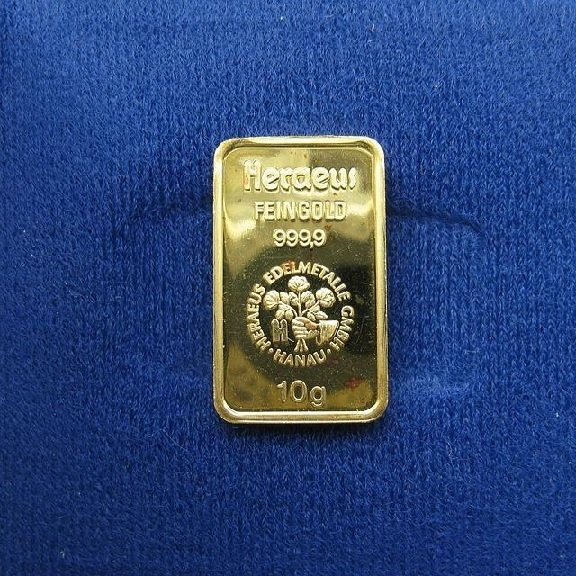

Image by <a href=”https://pixabay.com/users/nick_nam-4332094/?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=6727343″>nick_nam</a> from <a href=”https://pixabay.com//?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=6727343“>Pixabay</a>

Why Partner With A High Caliber Gold IRA Firm

Once your research is complete and it’s determined that a gold IRA is a suitable investment for your portfolio, a trusted, well-established gold firm like SD Bullion will make the process seamless and straightforward.

A less quality provider could make what’s already an expensive venture more hassle and ultimately a greater cost down the road.

One sign that a firm is legitimate and in good standing is if there’s a positive reputation on the market; you should have heard good things and know about their business practices, standards, and reliability. Go here for details on selecting a gold investment company, and then look at what constitutes the best gold IRA firm.

- A solid reputation speaks volumes

A company develops a bad reputation based on poor performance, inadequate knowledge or expertise, and lack of customer support. The best way to determine if a gold IRA firm has a positive reputation is to find out what other investors have to say.

A well-respected company like SD Bullion will have only glowing reviews from a substantial following of clients standing behind a solid reputation. The Better Business Bureau (BBB) will depict the business in a positive light with good ratings of B or higher and minimal complaints.

- The setup process is straightforward

Setting up a gold IRA is one of the intricacies that intimidate investors. Fortunately, the best gold IRA firms prioritize their investors’ best interests leading to the client’s success and that of the company.

One step in that process is making opening the precious metal account as straightforward as possible with little stress with the help of professional resources. The suggestion is that the setup should be no more than a few days with an assigned specialist for each investor.

Suppose there are any questions or concerns as you navigate through the process. In that case, the expert assigned to you should be knowledgeable and experienced to answer and provide additional facts to handle inquiries above and beyond expectations.

Photo by Anne Nygård on Unsplash

- Fees and charges should be competitive

Self-directed IRAs holding precious metals are an investment that takes careful forethought before committing because they come with a high price point.

Gold IRA firms will charge varying fees from one to the next, but these apply to the set up of the account, administration and management, and securing the investment in holding.

As with any product, if there were little to no cost, investors would rightfully question the legitimacy, knowledge, and expertise of the firm or whether the products would be quality or perhaps even authentic.

In that same breath, you want to receive competitive pricing by comparing firms and precious metal costs. SD Bullion boasts exceptionally fair prices across the board compared to other providers.

- The precious metal products should be varied

Investors open gold IRAs as a method for diversifying the holdings in their investment portfolio. The metals act to protect wealth and hedge against the threats posed to “paper” assets from market volatility, inflation, and uncertain economic times.

When looking for the ideal gold firm, clients hope to find a provider with a vast range in their IRA available line. Gold is not the only metal approved for holding in a gold IRA.

The IRS approved gold, silver, palladium, and platinum in bars, coins, and round. The stipulation is that these be of a specific purity.

Coins cannot be considered “rare or collectible” but instead have a particular designation from the IRS as IRA-approved. The best gold firm will guide buyers toward these products. A suggestion often posed to investors is to diversify their gold IRA.

Instead of solely holding one metal in the IRA, mix them up or have a few IRAs each for a different metal. Go to https://www.fool.com/investing/stock-market-market-sectors/materials/gold-stocks/gold/ for guidance on how to invest in gold and other precious metals.

Image by <a href=”https://pixabay.com/users/flaart-5950501/?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=4722600″>flaart</a> from <a href=”https://pixabay.com//?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=4722600“>Pixabay</a>

- The IRS-approved custodian

With a self-directed IRA backed by precious metals, as the account owner, the investments and funding will ultimately be your responsibility. Still, you won’t be able to store these in your home. A specialized custodian capable of holding precious metals will do so in an approved depository.

A gold firm can assist you with choosing a federally qualified custodian approved by the government. These can be credit unions, bands, or trusts. In any event, the entity should be insured, licensed, and registered for optimum servicing when protecting investment.

Once you fund the IRA and make your precious metals selections, the gold firm and the custodian complete the transaction. The custodial service will then take custody of the precious metal to be held in a secure, IRS-approved storage depository until the IRA matures.

No distribution can be made until that time. If an early withdrawal occurs, you will be subject to tax repercussions and penalties as the person held accountable with the IRA.

Final Thought

When investing in a gold IRA holding one of the IRA-approved metals, it’s wise to partner with one of the most reputed, well-established customer-centric firms like SD Bullion.

A high-caliber company aims to ensure its clients remain compliant with the IRS rules while preserving and continuing to work to build wealth for a thriving retirement future.